LMFP batteries, derived from lithium iron phosphate (LFP) batteries, are gaining traction in China, projected for deployment in mid-range electric vehicles (EVs).

Cost-effective LFP batteries hold a 60% share in the EV battery market in China, and the increasing momentum in large-scale LMFP battery production indicates its potential as a successor.

LMFP batteries are anticipated to find a niche in mid-range EVs, differing from mainstream LFP and ternary lithium-ion (NMC) batteries, with an expected rise in market share.

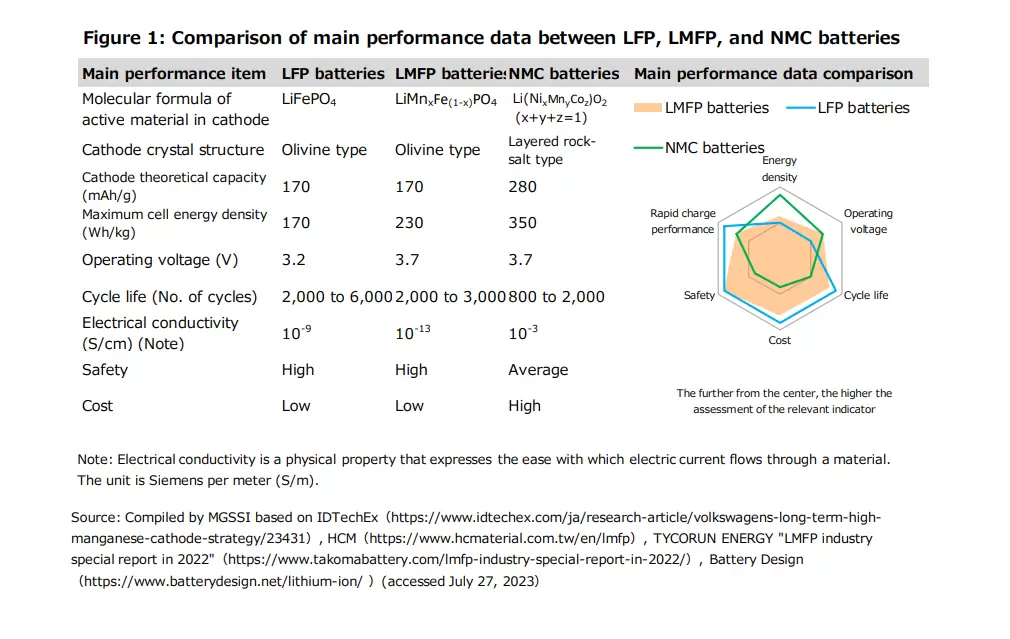

Currently, two primary types of batteries power global electric vehicles (EVs): lithium iron phosphate (LFP) batteries, utilizing lithium iron phosphate (LiFePO4) as the cathode material, and ternary lithium-ion (NMC) batteries, composed mainly of nickel, manganese, and cobalt compounds. While LFP batteries are safer and more cost-effective due to less use of rare earth elements like cobalt, their drawback lies in lower energy density, limiting EV range. On the other hand, NMC batteries boast higher energy density but pose safety concerns and are costlier due to cobalt and other rare earth elements.

LMFP batteries, based on lithium manganese iron phosphate (LMFP), a variation of LFP, address this energy density challenge by substituting manganese for a portion of the iron. This substitution allows LMFP batteries to maintain similar cost and safety levels to LFP batteries while providing approximately 15% to 20% higher energy density, positioning them as promising successors to LFP batteries. In China, with LFP batteries commanding a 60% domestic market share, plans for large-scale LMFP battery production are rapidly advancing. This report delves into its background, current trends, and future prospects.

LMFP features a highly stable olivine-type crystal structure, akin to LFP, ensuring minimal deformation during charging and discharging, alongside equivalent safety levels. In terms of thermal stability and cycle life, LMFP surpasses NMC with a layered rock salt structure, especially in theoretical capacity. While LMFP shares a similar theoretical capacity with LFP, its energy density is approximately 15% to 20% higher due to a working voltage around 0.5 V higher than LFP's 3.2 V. Cost-wise, the expectation is that, with its high energy density and the absence of cobalt or other rare metals, the cost per kilowatt-hour will match or be lower than LFP after large-scale production.

Despite challenges like low conductivity and manganese dissolution during charge-discharge cycles, recent advancements in nanoscale cathode materials and carbon coating technologies have propelled LMFP's cycle life beyond 2,000 cycles, signaling a path towards practical applications. The major performance data for LFP, LMFP, and NMC batteries are illustrated in Figure 1.

The production methods for LMFP closely resemble those for LFP, divided into solid-phase synthesis and liquid-phase synthesis. Although liquid-phase synthesis, involving the synthesis of a material mixture from a solution, is more complex than solid-phase synthesis, which entails grinding solids into smaller particles, it is better suited for producing high-performance LMFP as it enables more uniform material synthesis.

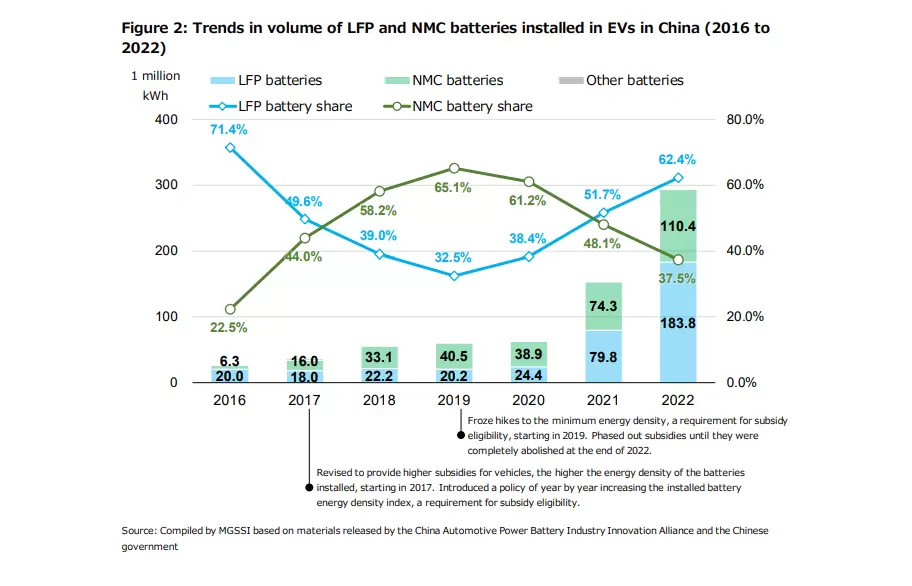

LMFP batteries are not a new technology, with BYD, China's largest electric vehicle manufacturer, announcing the development of LMFP batteries as successors to LFP batteries in 2014. However, despite facing technical challenges, the preference for high-energy-density batteries in China's electric vehicle subsidy program led to a decline in the market share of LFP batteries, impacted by systemic disadvantages, until 2020.

The shift in the subsidy program towards rectifying these biases from 2020, culminating in complete abolition in 2023, contributed to a resurgence in demand for cost-effective batteries. Consequently, LFP batteries regained a significant 62.4% share of China's electric vehicle battery market in 2022 (see Figure 2). According to IEA data, LFP batteries claimed 30% of the global electric vehicle battery market in 2022, marking a decade-high record. Approximately 30% of batteries in Tesla's electric vehicles are LFP batteries, and Ford plans to produce them in the U.S. by 2026, showcasing their growing popularity globally. Despite the steady expansion of LFP battery market share, mainly in China, its characteristic drawback of low energy density is gradually improving due to recent advancements in chemical properties.

Against this backdrop, LMFP batteries are once again gaining attention, having made significant progress in overcoming technical challenges for practical application.

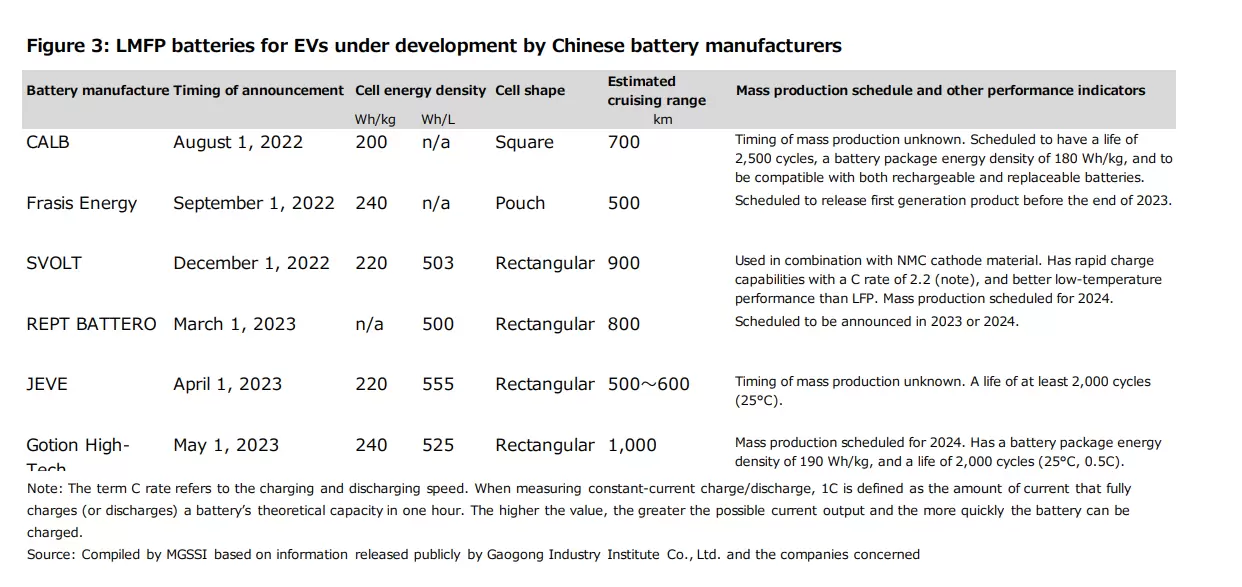

Being at the forefront of implementing LMFP batteries in actual use will help Chinese companies maintain a competitive edge, holding 90% of the global LFP battery production since 2022. Battery manufacturers and cathode material producers have been accelerating efforts towards large-scale production since 2022.

Figure 3 displays the performance metrics of LMFP batteries developed by major Chinese battery manufacturers for EVs. In August 2022, leading automotive battery company CALB announced an LMFP battery with a packaging energy density of 180 Wh/kg. Subsequently, several other battery manufacturers unveiled prototypes. The expected range for EVs equipped with these LMFP batteries developed by these companies falls between 500 km and 1,000 km, indicating their target for mid-range or higher-end models. In May 2023, China's fourth-largest battery manufacturer, Guoneng High-Tech, announced a 1,000 km range LMFP battery, planning mass production to commence in 2024. However, apart from a few companies, most prototypes are still under development or undergoing performance testing by EV manufacturers, and the time for large-scale production remains undetermined.

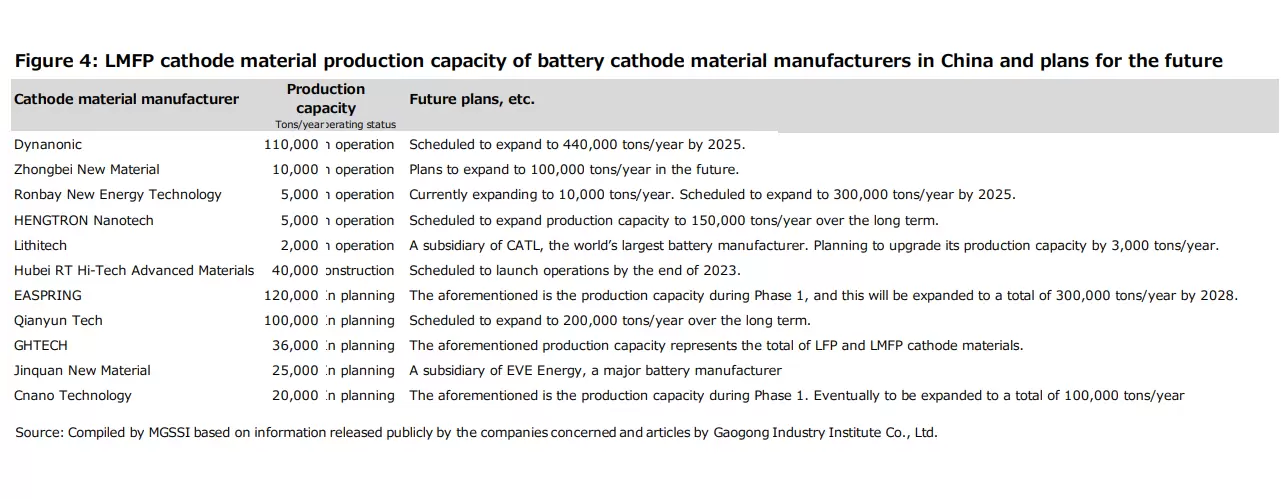

Battery cathode material manufacturers are swiftly preparing for large-scale LMFP cathode material production to preempt future demand. Nano-technology-focused Dynanonic plans to expand its current annual output from 110,000 tons to 440,000 tons by 2025. In July 2022, Ronbay Technology, a major cathode material manufacturer, announced plans to acquire 68.25% of SKLD, a startup with a current annual capacity of 5,000 tons, intending to expand it to 300,000 tons by 2025. One of the world's largest battery manufacturers, CATL, also acquired 100% equity in Lithitech, a startup with an annual capacity of 2,000 tons, planning to increase it to 3,000 tons.

As shown in Figure 4, the total capacities of various cathode material manufacturers, both operational and planned, reach several hundred thousand tons per year. However, currently, even operational factories primarily focus on small-scale production, such as producing sample products. Furthermore, except for a few companies like Dynanonic, most companies are expected to leverage solid-phase synthesis methods developed during LFP cathode material production, necessitating an evaluation of large-scale production product performance.

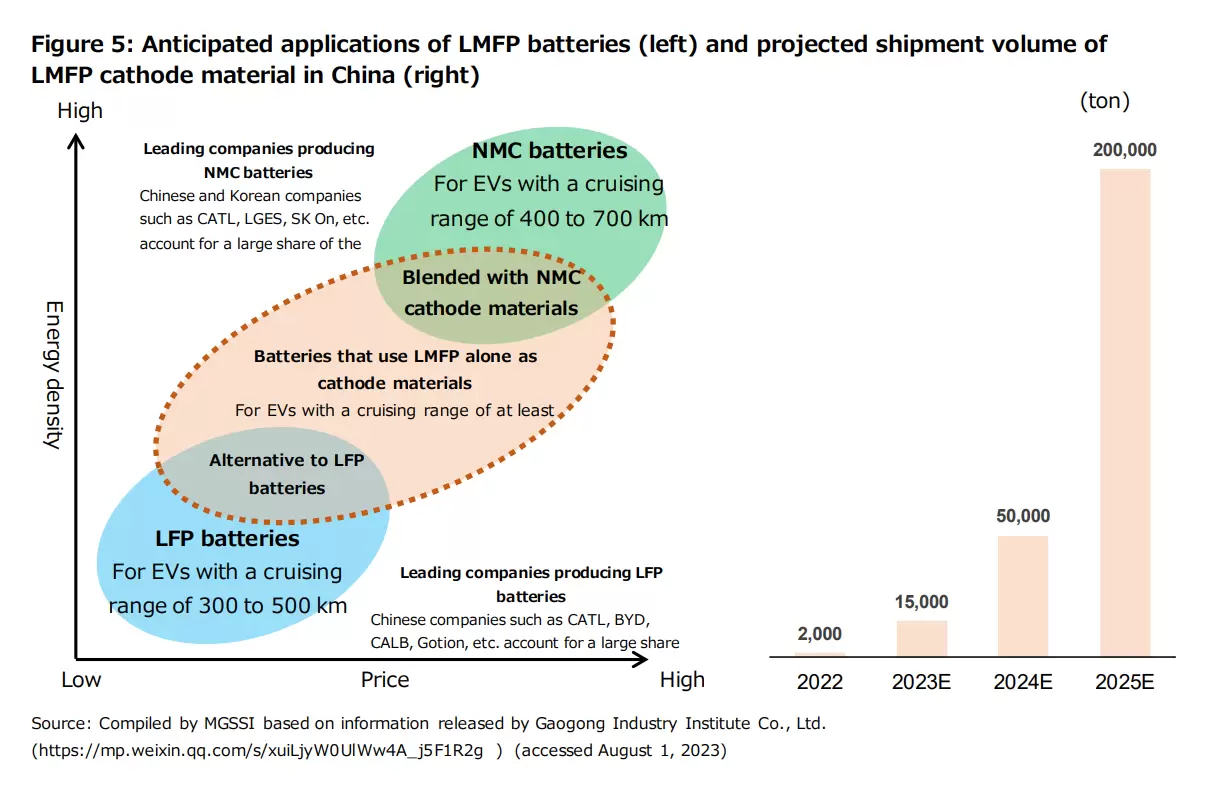

As illustrated in Figure 5 on the left, LMFP batteries position themselves between LFP and NMC batteries in terms of energy density and price. During the initial deployment phase in EVs, they are expected to find common applications as replacements for LFP batteries and in combination with NMC cathode materials. In the medium to long term, as technology matures, LMFP is expected to increasingly serve as the sole cathode material for mid-range EVs, distinguishing itself from the current mainstream LFP and NMC batteries. According to a report by China's Gaogong Industry Institute, if LMFP batteries achieve formal commercialization before 2030, their compound annual growth rate is anticipated to exceed 30% between 2025 and 2030. The commercialization of LMFP batteries could enhance China's competitiveness in the global battery market by providing a higher energy density alternative to the currently dominant LFP batteries.

However, there are some technical and market uncertainties for LMFP batteries. Firstly, despite demonstrating high cycle life in laboratory environments, real-world validation across broader temperature ranges and usage conditions is needed. Secondly, although LFP battery market share has recovered in China, globally, NMC batteries still dominate, posing a challenge for LMFP batteries to compete worldwide. Lastly, even if LMFP batteries achieve commercialization, their actual market share on the global stage will be influenced by factors such as the supply chain and market demand, introducing a degree of uncertainty into their future prospects.

Sanxin New Materials Co., Ltd. specializes in the production of ceramic milling balls, nanoparticles, and nanopowders, along with the manufacturing of wear-resistant ceramics and abrasion-resistant ceramics. In the realm of lithium manganese iron phosphate (LMFP) battery production, the use of zirconia balls for grinding proves to be a critical process. Zirconia balls, known for their exceptional hardness and wear resistance, play a pivotal role in the milling and refining of LMFP materials. Zirconia balls find extensive application in the production of LMFP batteries, contributing to the refinement of cathode materials. The grinding process ensures the desired particle size distribution, optimizing the performance and energy density of LMFP batteries.

For more advices and knowledge about Grinding Balls, Sand Millls, please contact with our sales:

Charls Shaw

Sales Manager |Sanxin New Materials

Mobile:+86 19070858212(WhatsApp)

Email:sales@beadszirconia.com

Website:https://www.beadszirconia.com

Submit your demand,

we will contact you ASAP.

Sanxin New Materials Co., Ltd. focus on producing and selling ceramic beads and parts such as grinding media, blasting beads, bearing ball, structure part, ceramic wear-resistant liners, Nanoparticles Nano Powder